The Nifty 50 was down 0.68% at 24,718.6 and the BSE Sensex fell 0.70% to 81,118.6.

Here’s how analysts read the market pulse:

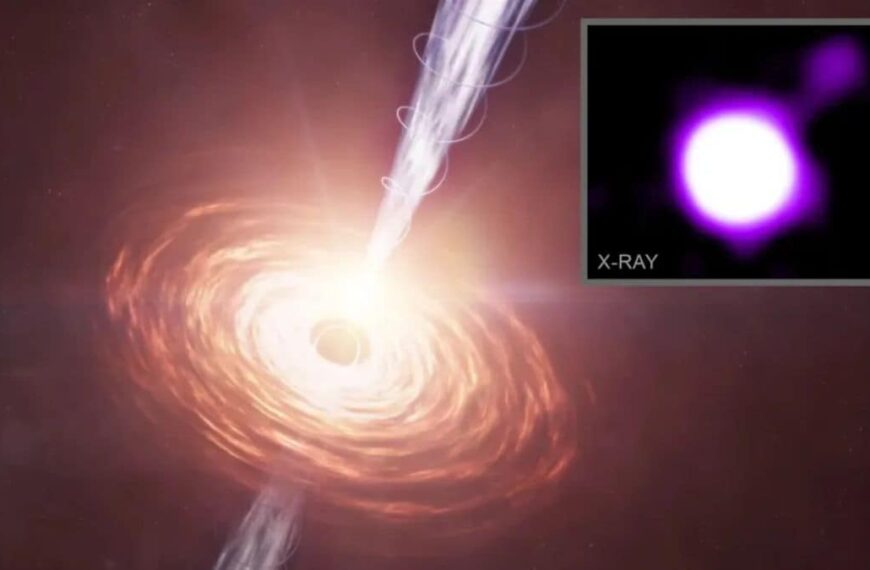

Indian equity benchmarks experienced downward pressure, driven by weak global cues and foreign institutional outflows, said Vinod Nair, Head of Research, Geojit Investments, adding that market sentiment was notably impacted by heightened geopolitical tensions following Israel’s military strike on Iran, which significantly increased risk aversion among investors.

“Although India’s CPI for May eased below the RBI’s comfort threshold—offering a positive macro signal—this was largely overshadowed by external headwinds. Brent crude prices climbed near $76/barrel, their highest this year, raising fears of inflation if tensions persist. Gold demand remains strong, reflecting a shift to safe-haven assets. In the near term, market sentiment is likely to stay cautious until geopolitical stability returns,” said Nair,

Also read | 5 Wall Street moguls who dismissed Bitcoin as a fad — Guess what they’re saying now!

US markets

Wall Street closed sharply lower on Friday after Iran fired missiles at Israel in retaliation for recent Israeli strikes targeting Tehran’s nuclear capabilities.The S&P 500 dropped 1.13% to finish at 5,976.97. The Nasdaq slid 1.30% to 19,406.83, while the Dow Jones Industrial Average fell 1.79% to 42,197.79.

European Markets

European shares ended lower on Friday as Israel’s large-scale strike on Iran sparked a broad market selloff, prompting investors to seek safety amid an already fragile trade environment.

The pan-European STOXX 600 index slipped 0.9%, briefly touching a three-week low. It also notched its fifth straight decline, marking its longest losing streak since September 2024.

Tech View

The Nifty slipped sharply, breaching the 21-EMA—a key short-term moving average, said Rupak De, Senior Technical Analyst at LKP Securities, adding that “however, it found support near the recent consolidation lows, leading to a strong intraday recovery.”

“Going forward, the recovery could gain traction if the Nifty sustains above the 24,700 level. On the upside, the index may move towards 25,000 in the short term. Conversely, a decisive fall below 24,700 could trigger renewed bearish bets in the market,” said De.

Also read | Warren Buffett’s biggest investment isn’t Apple, BofA or Coca-Cola — it’s a stock hidden in plain sight

Most active stocks in terms of turnover

Cochin Shipyard (Rs 2,147 crore), Jubilant Ingrevia (Rs 2,043 crore), BSE (Rs 2,040 crore), SCI (Rs 1,973 crore), InterGlobe aviation (Rs 1,756 crore), GRSE (Rs 1,461 crore) and BEL (Rs 1,398 crore) were among the most active stocks on BSE in value terms. Higher activity in a counter in value terms can help identify the counters with highest trading turnovers in the day.

Most active stocks in volume terms

Vodafone Idea (Traded shares: 46.91 crore), Reliance Power (Traded shares: 15.37 crore), Suzlon Energy (Traded shares: 9.03 crore), YES Bank (Traded shares: 8.67 crore), SCI (Traded shares: 8.63 crore), JP Power (Traded shares: 7.65 crore) and HFCL (Traded shares: 4.73 crore) were among the most actively traded stocks in volume terms on NSE.

Stocks showing buying interest

Shares of Jubilant Ingrevia, SCI, DB Realty, 360 One Wam, Narayana Hruday, ABB Power and Zen Technologies were among the stocks that witnessed strong buying interest from market participants.

52 Week high

Over 80 stocks hit their 52 week highs today while 57 stocks slipped to their 52-week lows.

Stocks seeing selling pressure

Stocks which witnessed significant selling pressure were Tata Teleservices, IREDA, InterGlobe Aviation, Reliance Power, Canara Bank, Ajanta Pharma and Crisil.

Sentiment meter bearish

The market sentiments were bearish. Out of the 4,122 stocks that traded on the BSE on Friday, 2,595 stocks witnessed declines, 1,401 saw advances, while 126 stocks remained unchanged.

Also read | Which companies have large exposure to Pakistan bordering states? CLSA analyses retaliation risk

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of the Economic Times)