The other two counters are Atul Auto and Innovators Facade Systems, in which the ace investor has 20.9% and 10.7% holdings.

The recent correction in this counter has brought Tac Infosec below its 50-day simple moving average (SMA) of Rs 1,220, though it is still trading above its 200-day SMA of Rs 1,052, according to Trendlyne data.

The stock has traded with relative stability for the past year, with a 1-year beta of 0.8.

The stock was listed on the NSE on April 5, 2024.

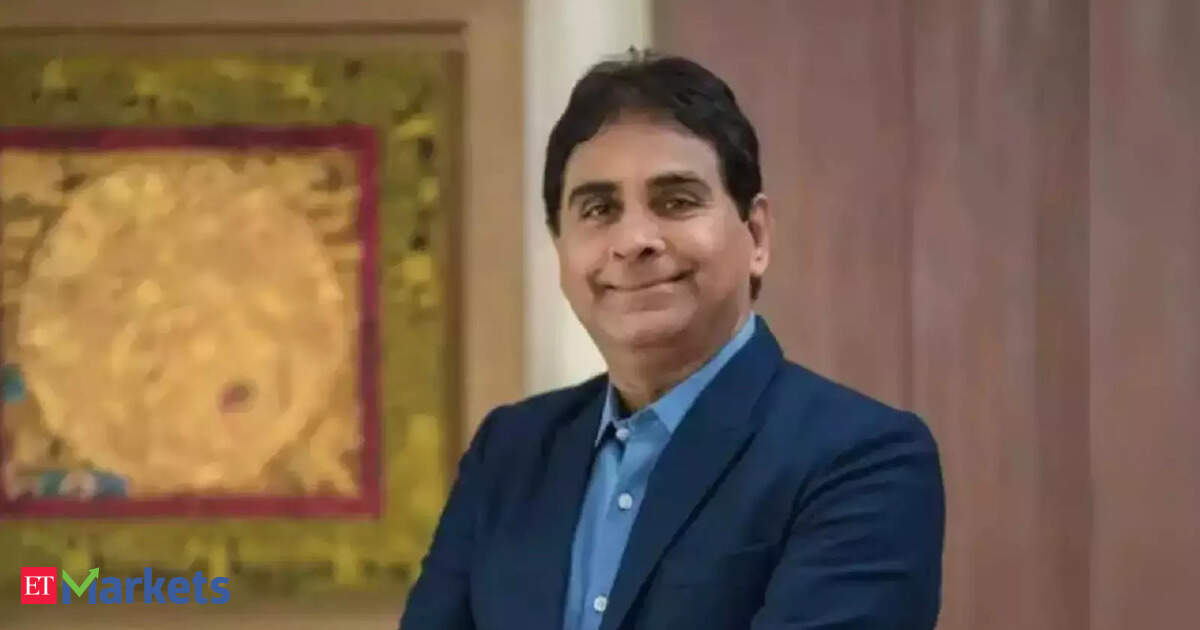

Tac Infosec stock closed at ₹1,200 on the NSE on Tuesday, down Rs 22.50 or 1.84% from its previous day’s close. Kedia’s portfolio is among the most followed among ace investors on the D-Street. He began investing in the stock market at the age of 19 and started Kedia Securities in 1992, when he was 33. As per the latest corporate shareholdings data compiled by Trendlyne, Kedia publicly holds 15 stocks with a net worth of over Rs 1,438.4 crore.

Also Read: Private lenders disappoint in Q4FY25, but small and PSU banks impress. HDFC Bank, SBI among 16 stocks to buy

Among other stocks in his portfolio are Sudarshan Chemical, Global Vectra, Tejas Networks, Precision Camshafts, Elecon Engineering, Mahindra Resorts, Neuland Laboratories, Siyaram Silk Mills and Affordable Robotic.

Vijay Kedia follows an investment philosophy focused on identifying companies with strong management and holding them for 10–15 years. He adopts the SMILE approach—investing in businesses that are Small in size, Medium in experience, Large in aspiration, and Extra-large in market potential.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of Economic Times)