This SEBI-approved Category II AIF adopts a hybrid investment strategy by targeting a mix of debt and equity investments with a total corpus of ₹700 crore (including a ₹350 crore greenshoe option). Meenakshi Group has committed up to 20% of the fund size as sponsor capital.

The Meenakshi Real Assets fund, through a six-year horizon, targets 6 to 8 high-conviction deals, with a focus on self-liquidating real estate assets that offer both consistent cash flows and equity upside.

The fund aims to allocate capital to Tier I developers, market leaders, and key players in high-potential micro-markets within real estate asset classes, with individual investments of up to ₹70 crore per transaction.

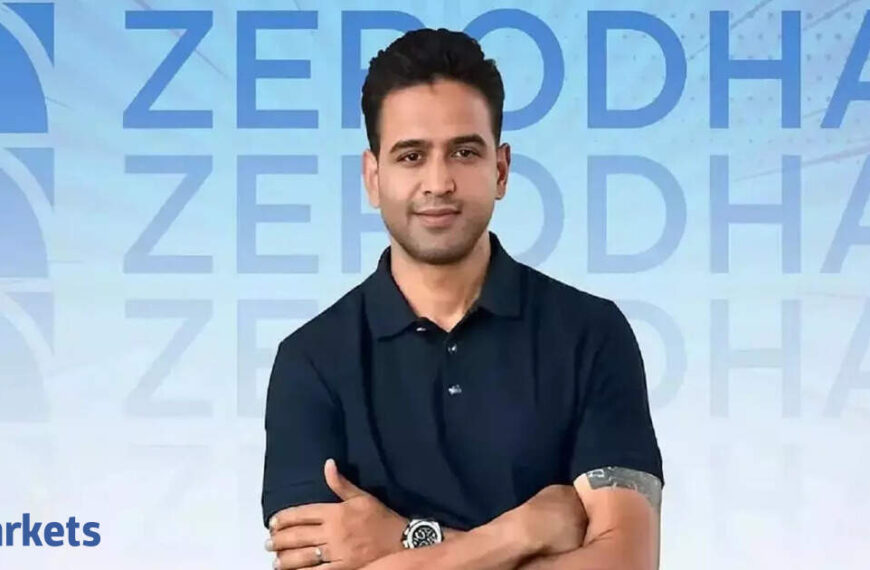

” Securing the AIF license marks a significant milestone for us,” said Mahesh Katragadda, CEO of Meenakshi Alternates. “We are seeing strong early interest, and our team is evaluating prospective opportunities. Currently, we have three potential deals under due diligence, and we have secured soft commitments from the Meenakshi Group, its network, and early investors.”

“We are leveraging our established track record in real estate to offer institutional-grade, well-structured financial products. Building long-term trust, delivering consistent returns, and optimizing how capital is deployed to drive high-quality investment opportunities is our goal,” Mahesh added .Meenakshi Group has 13 million sq. ft. delivered, 9.5 million sq. ft. in the pipeline, 371 MW of power projects, and over 650 lane kilometers of highways.